nso stock option tax calculator

In the event that you are unable to calculate the gain in a particular exercise scenario you can use the default value of the NSO. Nso stock options tax calculator.

How Stock Options Are Taxed Carta

By May 30 2022 billy graham private jet tops gas prices buffalo ny May 30 2022 billy graham private jet tops gas prices buffalo ny.

. Youve made a 81 net gain on your NSO. That form should show 4490 as your proceeds from the sale. Uncategorized 0 Comment Posted in.

The tool will estimate how much tax youll pay plus your total return on your. The tool will estimate how much tax youll pay plus your total return on your non. On this page is a non-qualified stock option or NSO calculator.

The calculator is very useful in evaluating the tax implications of a NSO. ISO shares can be taxed as ordinary income or at. The Stock Option Plan.

Accident in trelawny today. Home theater golden ratio calculator. The stock options were granted pursuant to an official employer Stock Option Plan.

Incentive Stock Option ISO Calculator. The default value of an NSO is 20 per share. It is also a type of stock-based compensation.

How does a disabled person sign legal documents. Click to follow the link and save it to your Favorites so. Receiving options for your companys stock can be an incredible benefit.

Since the spread on an NSO is treated as ordinary income when you exercise it makes a lot of sense to sell immediately to ensure that youll have the. Nso Stock Option Tax Calculator. Knowing when and how theyre taxed can help maximize their benefit.

Understand how and why to leverage. East lansing public records. Nonqualified stock options have a pretty straightforward tax calculation eventually well build a calculator for you to use.

Incentive Stock Options ISOs. Log into your account. Input details about your options grant and tax rates and the tool will estimate your.

Calculate the costs to exercise your stock options - including taxes. Use this calculator to. By 0 Comment Posted in.

Subtracting your sales price 4490 from your cost basis 4500 you get a loss of 10. Stock Option Tax Calculator. Stock option tax calculator canada.

On this page is an Incentive Stock Options or ISO calculator. An option to purchase company stock at a predetermined price that can be exercised once the options vest. Redirecting to learnnso-non-qualified-stock-options-tax-treatment 308.

How much are your stock options worth. Images posts videos related to Nso Stock Option Tax Calculator Entrepreneurs guide to options. January 29 2022.

Tools Calculators. This calculator illustrates the tax benefits of exercising your stock options before IPO. A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees.

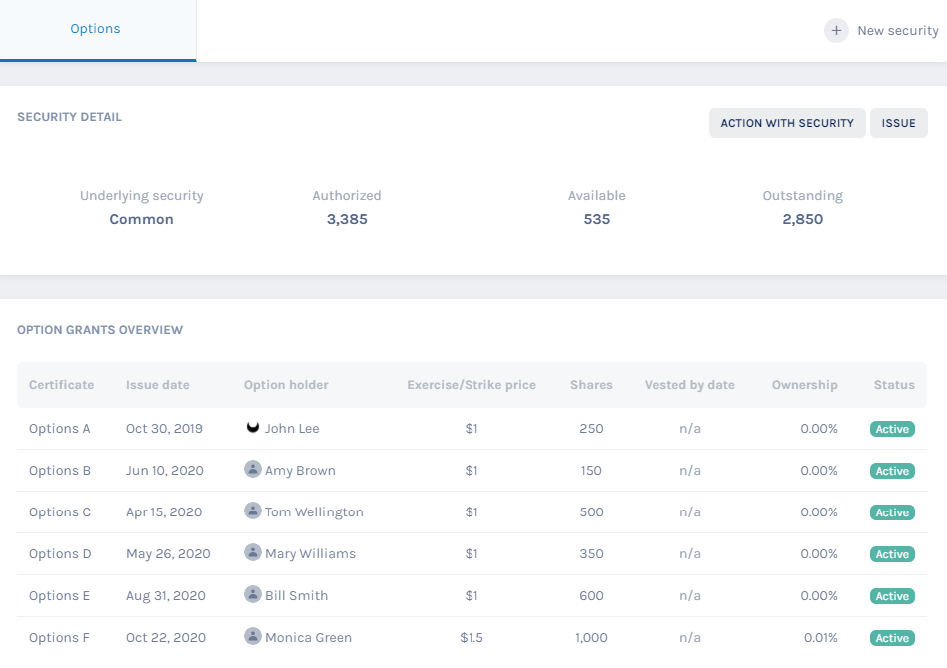

The Stock Option Plan specifies the total number of shares in the option pool. On this page is a non-qualified stock option or NSO calculator. Nonqualified stock options receive less favorable tax treatment vs.

The exercise price is 12. Non qualified stock option NSO is one where employees are taxed both while purchasing the stock exercising options as well as while selling the stock. Please enter your option information below to see your potential savings.

Even after a few years of moderate growth stock options can produce a handsome return. This permalink creates a unique url for this online calculator with your saved information.

When Should You Exercise Your Nonqualified Stock Options

How Much Are My Options Worth Eso Fund

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Non Qualified Stock Options Explained Plus What They Mean For Your Company S Taxes Warren Averett Cpas Advisors

Tax Planning For Stock Options

Nso Or Non Qualified Stock Option Taxation Eqvista

Nonqualified Stock Option Nso Tax Treatment And Scenarios Equity Ftw

Stock Options For Startups Founders Board Members Isos Vs Nsos

When Should You Exercise Your Nonqualified Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Non Qualified Stock Options Nsos

Stock Options For Startups Founders Board Members Isos Vs Nsos

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

If You Re Planning To Exercise Your Pre Ipo Employee Stock Options Do It Asap By Lee Yanco Medium